Toronto Real Estate – Are Investment Properties Carrying Themselves In Today’s Market?

The Toronto real estate market has been known for its robust performance over the years, with property values experiencing steady appreciation regardless of their high and lows. Investment properties, particularly rental properties, have been popular among investors due to the potential for rental income and capital gains.

Whether investment properties carry themselves in the market depends on various factors, including property prices, rental demand, vacancy rates, interest rates, and economic conditions. During periods of strong price growth and high rental demand, investment properties may indeed generate enough rental income to cover mortgage payments, property taxes, condo fees, home insurance and other expenses. In such cases, the property is said to be “carrying itself” or “cash flow positive.” But when property prices surge faster than rental rates and interest rates follow the same trend because of government policy, the possibility for a property to carry itself decreases to the point where cash flow becomes negative.

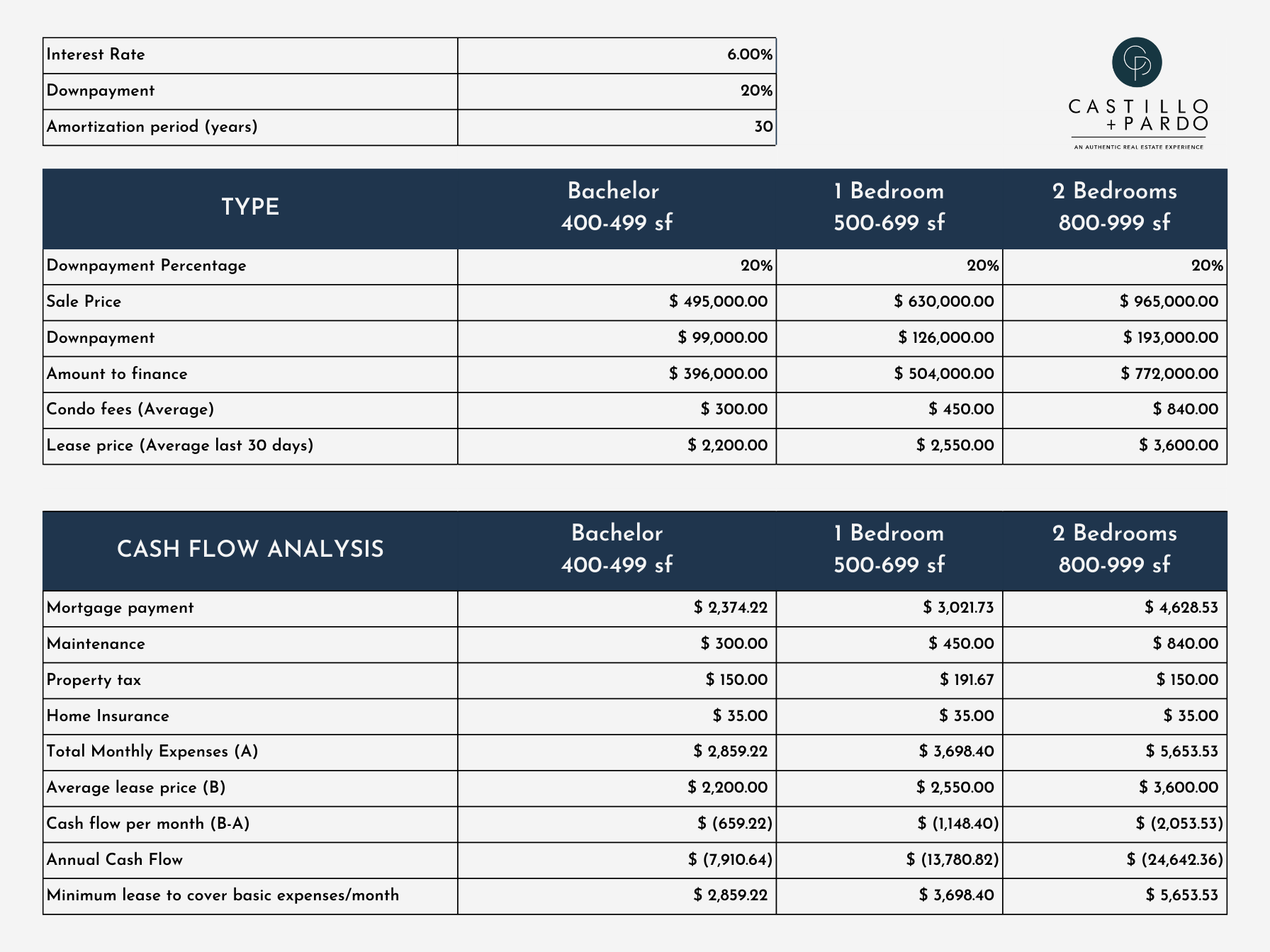

To determine the current state of the Toronto real estate market and whether investment properties are carrying themselves, we would need to analyze them from the Cash Flow perspective, and we are including 3 examples to consider.

This analysis is based on condominium suites purchased with 20% downpayment, a mortgage rate of 6% and amortization period for 30 years. All prices and fees related to the properties used for the analysis are an average of sales and leases that took place in Downtown Toronto (Districts C01 and C08 – Waterfront Communities – that means South of Bloor St and between Liberty Village and the Don Valley Parkway), in the last 30 days. Keep in mind that every location and property can have a different dynamic, and averages are not necessarily indicative of the situation of your property or one you want to purchase.

When evaluating income properties, investors should consider both cash flow and potential equity gain as part of their overall investment strategy. A balanced approach that takes into account both your short-term cash flow needs and the long-term equity growth potential is often advisable.

For some investors, immediate cash flow is a priority, and they may seek properties with strong rental demand and positive cash flow from day one. On the other hand, other investors may be more focused on long-term appreciation potential and are willing to accept short-term negative cash flow if they believe the property’s value will increase significantly over time.

Ultimately, the decision to invest in income properties in Toronto should be based on a comprehensive analysis of the property’s financials, market conditions, personal investment goals, risk tolerance, and long-term financial strategy.

For a more accurate analysis and if you’d like more information about this, please contact us or message us on Instagram. We’ll be happy to answer your questions.